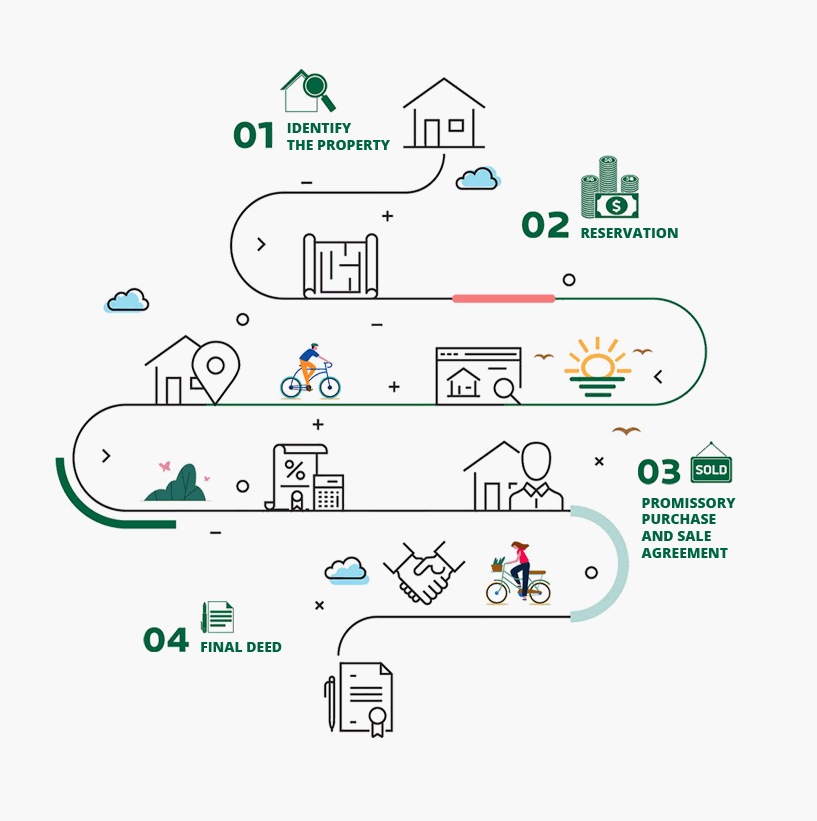

We know buying a house in a foreign country is a serious decision that requires a lot of deliberation. Matters such as taxes, security, or bureaucracy come to mind immediately relating to how we will manage the purchase. However, we want to make sure you are not intimidated by these aspects, and we have developed a graphic summary to compile all the information about each step along the way.

Naturally, we will be constantly available for any questions you may have about the process, to help and guide you in your purchase decision.

Please contact us on our email (comercial@islacanela.es) or our phone number (+44 (0) 1737 735 014).

01 IDENTIFY THE PROPERTY

Asset Concluded

Asset Off-plan

02 RESERVATION

Payment of a deposit and signature of a reservation document

Compliance-anti-money laundering check

03 PROMISSORY PURCHASE AND SALE AGREEEMENT

This agreement identifies, notably, the buyer and the seller, the exact price and payment terms, reps&warranties, remedies in case of default and date of execution of the final transfer deed

Payments

Asset concluded: total price minus the reservation deposit

Off-plan-asset

25% minus the reservation deposit

Tax: 10% on top of the price

04 FINAL DEED

After receiving the use license

Signed in front of notary

Transfer or ownership enforceable against third parties upon registration of the acquisition in the land registry office

Payment of the remaining price

OWNING COSTS

Annual costs

Property insurance

Contents insurance

Municipal Tax (IBI)

A coefficient is applied to the cadastral value, the depends of the City Council

CONDOMINIUM COSTS

Depends on the development and the size of property

1 Bedroom – between 50-70€/month

2 Bedroom – between 70-1500€/month

3 Bedroom – between 80-2000€/month

TRANSACTION COSTS

COST:

Legal fees

Notary

Registration Fees

Stamp Duty (IS)

VAT tax: 10%

% PURCHASE PRICE

Not related with the purchase price

Depends on the complexity and purchase price

Between 600-1000€ depending on the property cost 1,5%